So you want to be an artist at the renaissance festival?

What a great way to express your inner soul! Freedom to draw, to sculpt, to perform and let out that hidden child! And to get paid for it! You pour your heart and soul into your creations. And the people flock to see you perform, or to buy your art … waiting to see you, standing there.

And, at the end of the year, there stands one more person … the tax man.

Wait! What? You thought you would be ‘an outlaw’, that you could live ‘outside the system’.

Well, in a sense, yes. Our life as artists and performers do give us a wonderful, free lifestyle. But if you are in this for a living – and especially for profit – taxes are a part of it.

Paying taxes is a part of any small business, and that’s really all we are – small businesses. Small Business is defined by the Small Business Administration (and the IRS) as being a business with less than 500 full time employees. I think most of us fall under that.

For some of us, taxes are easy. For others, it’s an impossible labyrinth to navigate. Working in “the other world”, we file our 1040EZ, 1040A or 1040, and sometimes take a few familiar deductions or credits – education, home mortgage, child care or unreimbursed business expenses. But as a small business, there are more forms and more paperwork than that.

There are few of us who would file as anything more than ‘sole proprietor’. Sole proprietor can be an individual or a married couple, same as on your standard 1040; you can choose to designate one person as the primary business owner or you can mark ‘jointly owned’. You can form a partnership (for those committed but unmarried partners not in a personal relationship) or S-Corporation, if either of those structures best suit your needs. Partnerships and S-Corporations do not pay taxes themselves, but they are what you call ‘pass-through’ entities, and the partners will pay taxes on the profits. But partnership and S-Corporations filings are for another article, as they are more complex in paperwork.

In a ruling in late August in 2013, the Department of Treasury and the IRS will recognize same-sex marriages for those filing MFJ and MFS (married filing jointly and married filing separately) status on your federal return. You must be legally married in a state that recognizes such marriages, but you don’t have to be living in or filing from a state that recognizes same sex marriages. However, the ruling does not apply to registered domestic partnerships, civil unions or similar formal relationships recognized under state law.

Sole Proprietors – we small artistes and thespians – will file a Schedule C along with our 1040. Known by tax nerds as “Business Profit or Loss”. There isn’t a lot to it. It’s all of 2 pages long, unless you have depreciation. But don’t panic! Learning the tax end of making a living at renaissance faires and outdoor festivals only takes up a little of your time, but it is a very important part of your time.

As a small business, you have to remember to put aside some of that very, very hard earned money to pay your federal taxes. Remember that, back in the old world job, they withheld that very, very hard-earned money with each paycheck. Not so now, young entrepreneur, you have to do it yourself. You also have to set aside the monies yourself to pay for your SE tax – nerdy for Self Employment tax.

Holy Mother of Unicorns! SE tax? What the heck is that? “I thought I left the other world to get away from the system!” Explained simply, your SE tax is your Social Security replacement. It goes towards your retirement. No, we WON’T get into any type of debate or discussion about whether or not Social Security will be there for you when you’re ready. This is not part of the scope of my expertise.

But filing as a self employed person has its perks. You can get away with deducting a lot of your funny clothing. Costumes are a required part of what we do for our job and therefore are legitimate business deductions, and many of our costumes cost a lot. And I’ve noticed a lot of us wear our costumes out in the real world. Keep in mind that in order to deduct ‘business clothing’ that it must be substantially for business use and cannot be clothing that you wear in normal life activities such as going shopping, or out to dinner with friends, or to a wedding. I know, I know, some of us will do that anyway. And you can still write off a lot of your funny clothes.

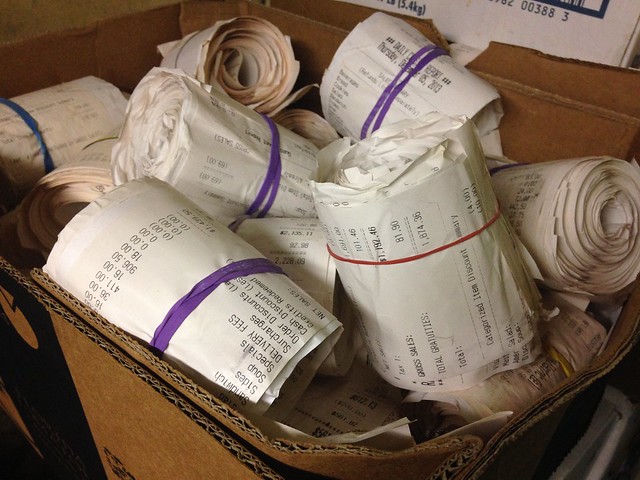

Learning to file your own quarterly taxes – both state and federal – is just another part of being a successful small business. I enjoyed Ronn Bauman’s article “So you want to work at at Renaissance Festival?”, and his discussion on the different levels of participation. Being a self employed artist or performer brings a myriad of new jobs into your life. Bookkeeping is one of them.

And taxes aren’t just for the full time renaissance artist or performer. Do you work a regular 9 to 5 in the city and you just come out and work weekends for your artist friend?

Yes, you are supposed to report that cash he/she pays you. Oh, they gave you a $300 leather vest in exchange for your pass and time worked? According to IRS Publication 17, you’re supposed to report the fair market value of that as income too (and the value of the pass). But as long as your 1040 is in good shape otherwise, I wouldn’t stay awake nights worrying if the IRS is going to bust down your doors to audit you if you don’t mention it. If you worked a couple of festivals for different booths, but you still have your 9-5 in the city, whether or not you get a 1099-MISC from your artist friends in January, you will have to file a Schedule C with your 1040 and pay SE tax on that income unless the total of that income for the entire year is less than $400. And you will do the same if you are a full time working rennie, one who isn’t a booth owner or performer, but you just travel around working for those who do own booths. Because you are in business for yourself; you just sell your labor instead of stuff.

Now bears the big question. Do you HAVE to pay the King’s Tax? Well, it is the law of the land. It’s your own personal moral issue if you want to roll the dice that way. But there are a few thoughts that might help you out.

The IRS does not require you to file a tax return if you do not owe any tax, and with personal deductions and exemptions, there is a minimum amount you need to make before you will owe any tax. Bear in mind, however, that while you may not owe any federal tax, you may likely owe SE tax. However, it is highly recommended that you DO file a tax return if you are owed any refund or are eligible for one of several refundable credits. After all, it’s your money. You do want it back, don’t you? And if you are just starting out a new business, the IRS doesn’t care if you don’t show a profit for the first few years. Generally you need to show a profit within 5 years, preferably 3. But be careful about red flags – things that make the IRS notice you. Don’t tell the IRS that you haven’t make a dime of profit for the last 10 years or they might ask you “What are you living on?” And if you tell them you are living off of your boyfriend, don’t tell them that your boyfriend hasn’t filed a tax return in 15 years (that really happened).

Taxes are seldom difficult. They just take time, just as your marketing does. There are sometimes issues that are confusing to the right brainers of the world. But learning your way around tax talk will take a couple of tries and there are plenty of reliable resources – from professional tax preparers to the www.irs.gov website – out there to consult for the legal and safe answers. In future articles I will address more specific subjects such as depreciation and sales of business assets, and pretty soon you’ll be as comfortable with those terms as you are swinging fire poi at a Funky Formal.

Thanks! This was very helpful~

Awesome article, Kerry, I can’t wait to read the follow ups! I used to tackle my taxes by myself with the help of H&R Block software, but recently it’s gotten to be so complicated and quite honestly, stressful, that I decided to find an accountant. Now I feel confident having a professional do my taxes, but I have mad respect of folks still doing their own!

Glad to hear it all works for you Jana. CPA’s – accountants – actually are only trained in tax law a little bit. Being a CPA encompasses so much more than tax preparation and not all CPA’s hold a PTIN (Personal Tax Identification Number – purchased each year from the IRS and is required if one prepares taxes for others for compensation). There are, in fact, many accountants who don’t know the first thing about doing their own taxes. It all depends on what one specializes in. Enrolled Agents, however, are the highest level of tax authority recognized by the IRS. They do nothing but taxes. Both PTIN holders and EA’s, as well as CPA’s are regulated by the IRS on strict due diligence and ethics and there are very stiff penalties for filing false returns and all three must pass criminal background checks. And CPA’s and EA’s must maintain certain levels of continuing education each year to maintain their status (40 hours for CPA and 17 hours for EA) and they also must keep their fingerprints on file. PTIN user’s to have to take 15 hours of CE but the January 2013 ruling in Loving vs IRS struck that down). So do your research when looking for a professional to help you with your taxes. And once you find one that you like and are comfortable with, this is one relationship that you should keep for a lifetime. Don’t bounce around.